Long Term Gain Tax Rate 2025

Long Term Gain Tax Rate 2025. Britain's pound has bounced ahead of an expected landslide election win for the opposition labour party but the currency's future depends on the next government. President biden’s $7.3 trillion fy 2025 budget, proposes several tax changes aimed at wealthier taxpayers, including a minimum tax on billionaires, a near doubling of.

Industry and investors have been seeking a simplification of the regime. So investors will get the next interest rate of the rbi floating rate savings bonds on january 1, 2025.

Here The Question Arises Whether Mr.

If your taxable income is from $47,026 to $518,900, you’ll pay 15% on your.

How Would The Capital Gains Tax Change Under Biden’s Fy 2025 Budget Proposal?

It adjusts the purchase price of assets to account for inflation, thereby.

Long Term Gain Tax Rate 2025 Images References :

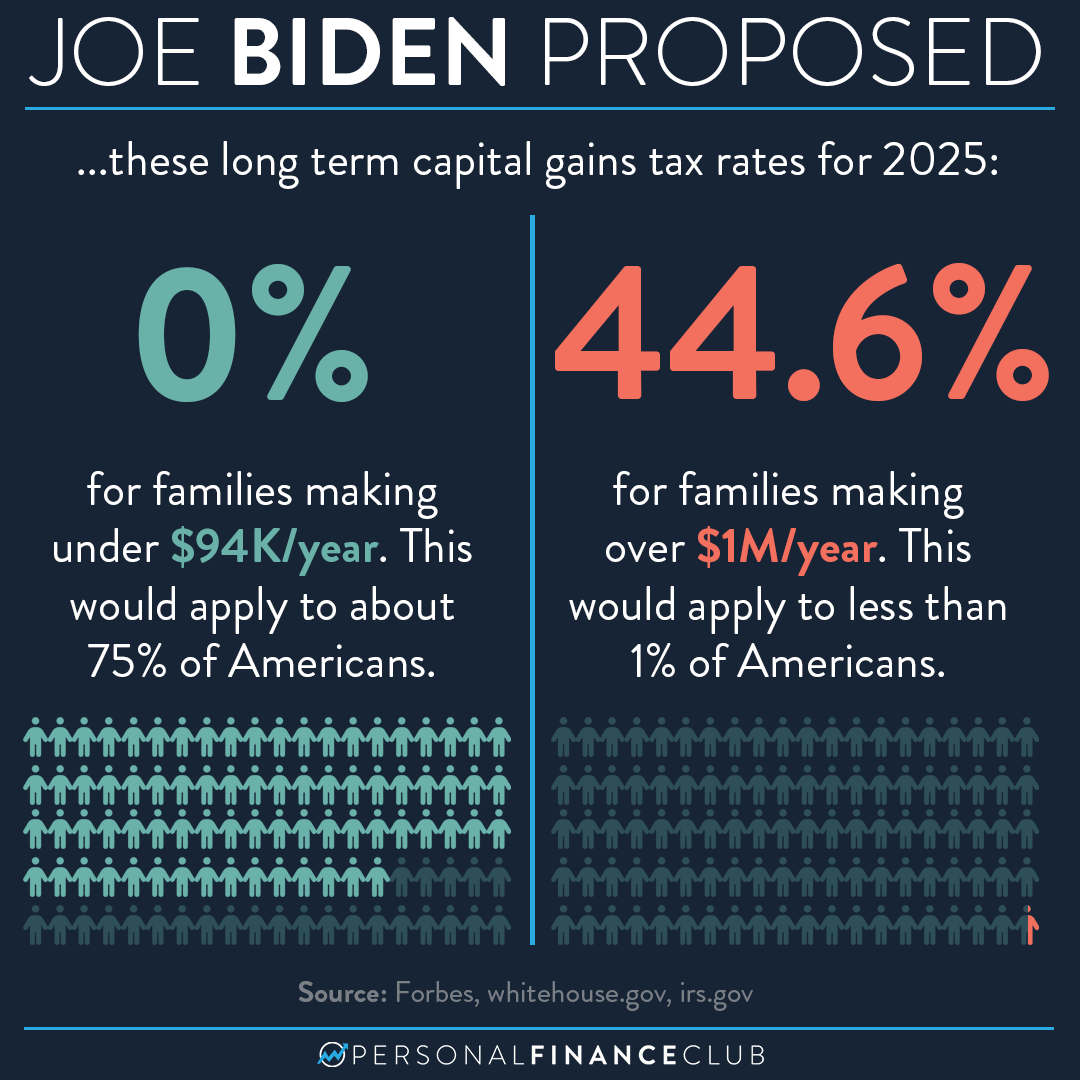

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

Joe Biden’s proposed long term capital gains tax rates for 2025, Budget 2023 & latest mutual funds taxation rules. What is long term capital gains tax or ltcg tax?

Source: thenewsintel.com

Source: thenewsintel.com

ShortTerm And LongTerm Capital Gains Tax Rates By The News Intel, Industry and investors have been seeking a simplification of the regime. Ltcg tax is a tax that investors need to pay on the profit generated from the sale of a capital asset held for a specific period.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

ShortTerm And LongTerm Capital Gains Tax Rates By, How would the capital gains tax change under biden’s fy 2025 budget proposal? Most times, ltcgs are taxable at a rate of 20% plus surcharges and cess as applicable.

Source: carissawtilda.pages.dev

Source: carissawtilda.pages.dev

Long Term Capital Gains Tax Rates 2024 Gerti Juliane, When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

Can Capital Gains Taxes Push Me Into A Higher Tax Bracket? The Long, When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains. Capital gain taxation in budget 2024:

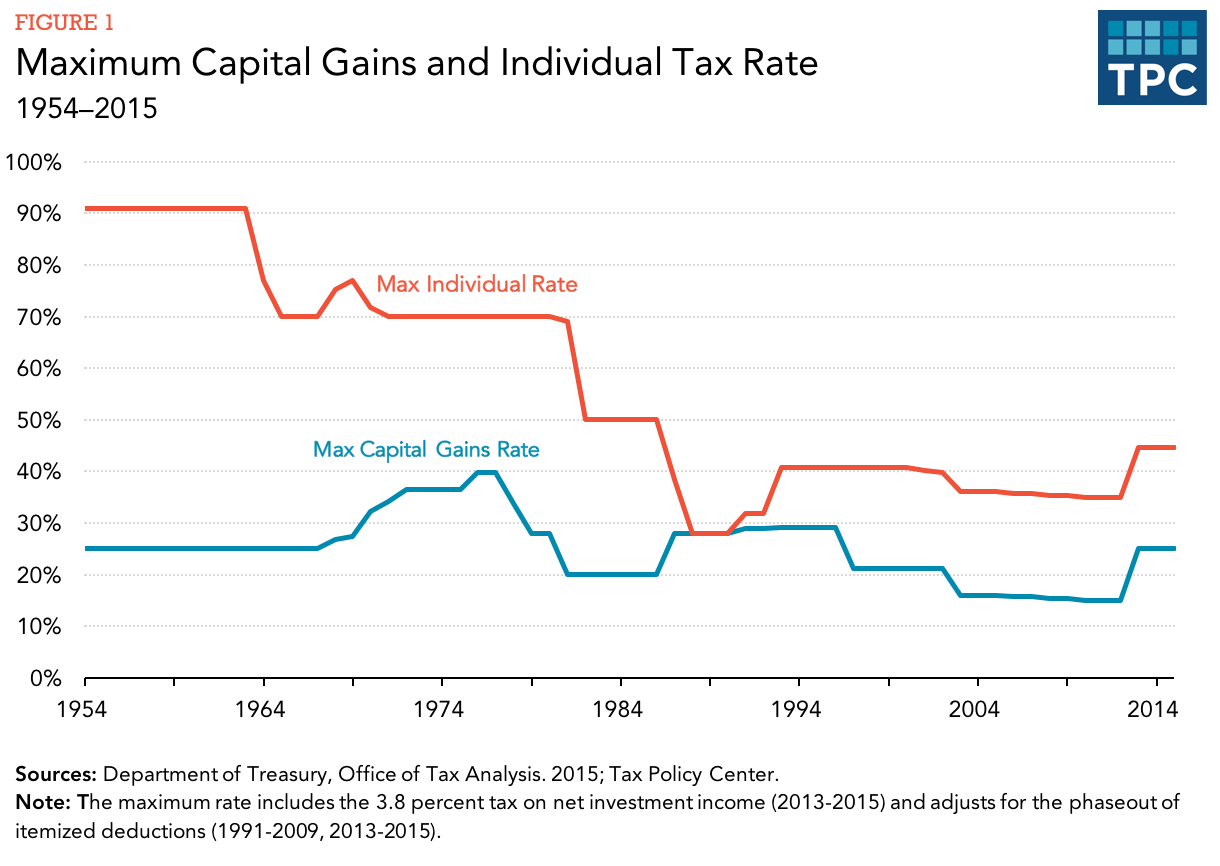

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

How are capital gains taxed? Tax Policy Center, Britain's pound has bounced ahead of an expected landslide election win for the opposition labour party but the currency's future depends on the next government. Exemptions and deductions, like the annual rs.

Source: your-projector-site.blogspot.com

Source: your-projector-site.blogspot.com

new capital gains tax plan Lupe Mcintire, Budget 2023 & latest mutual funds taxation rules. Britain's pound has bounced ahead of an expected landslide election win for the opposition labour party but the currency's future depends on the next government.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

ShortTerm And LongTerm Capital Gains Tax Rates By, Industry and investors have been seeking a simplification of the regime. Elss also taxed at 10% on.

Source: www.squareyards.com

Source: www.squareyards.com

Long Term Capital Gains Definition, Taxation and Computation, Most times, ltcgs are taxable at a rate of 20% plus surcharges and cess as applicable. When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

ShortTerm And LongTerm Capital Gains Tax Rates By, It adjusts the purchase price of assets to account for inflation, thereby. Here the question arises whether mr.

Ltcg Tax Is A Tax That Investors Need To Pay On The Profit Generated From The Sale Of A Capital Asset Held For A Specific Period.

If your taxable income is from $47,026 to $518,900, you’ll pay 15% on your.

Capital Gain Taxation In Budget 2024:

How would the capital gains tax change under biden’s fy 2025 budget proposal?

Category: 2025